Daniel Tencer | Huff

It was little more than a year ago that Deutsche Bank declared Canada’s housing market to be the most overvalued in the world, and on Thursday the German-based bank doubled down on its bearish assessment of Canada.

Residential real estate in Canada is overvalued by 63 per cent, according to research from Deutsche Bank chief international economist Torsten Slok.

Broken down, Slok sees the market as being 35-per-cent overvalued when compared to incomes, and 91-per-cent overvalued when compared to rents. That’s a more bearish assessment than most. The Bank of Canada estimates the market is overvalued by between 10 per cent and 30 per cent.

But those are similar numbers to those at the Economist magazine, which for years has been calling Canada’s housing market overvalued. It pegs the overvaluation at 32 per cent, when compared to incomes, and 75 per cent, when compared to rents.

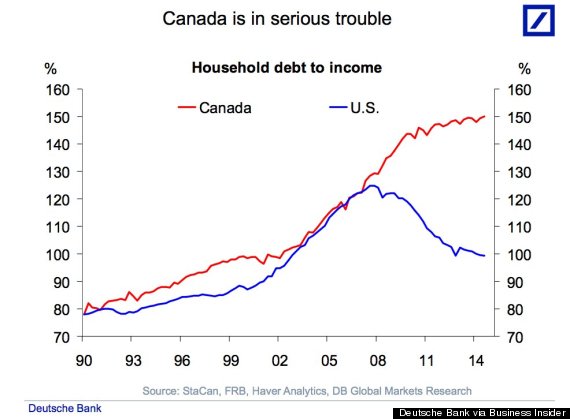

“Canada is in serious trouble,” reads the title of a chart from Slok’s report, showing Canada’s household debt, as a percentage of income, climb to 50 per cent above current levels in the U.S.

No comments:

Post a Comment